News

Aerospace & DefenceAutomotiveEnergyManufacturingMarineMedicalOil & GasRail

Manufacturing

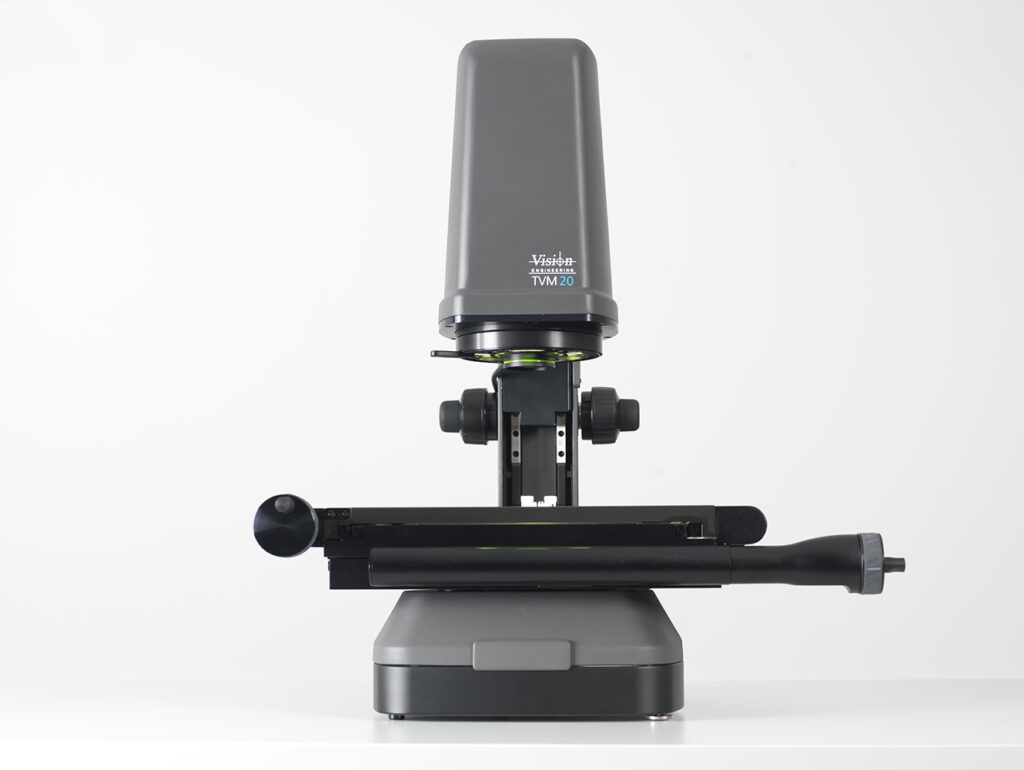

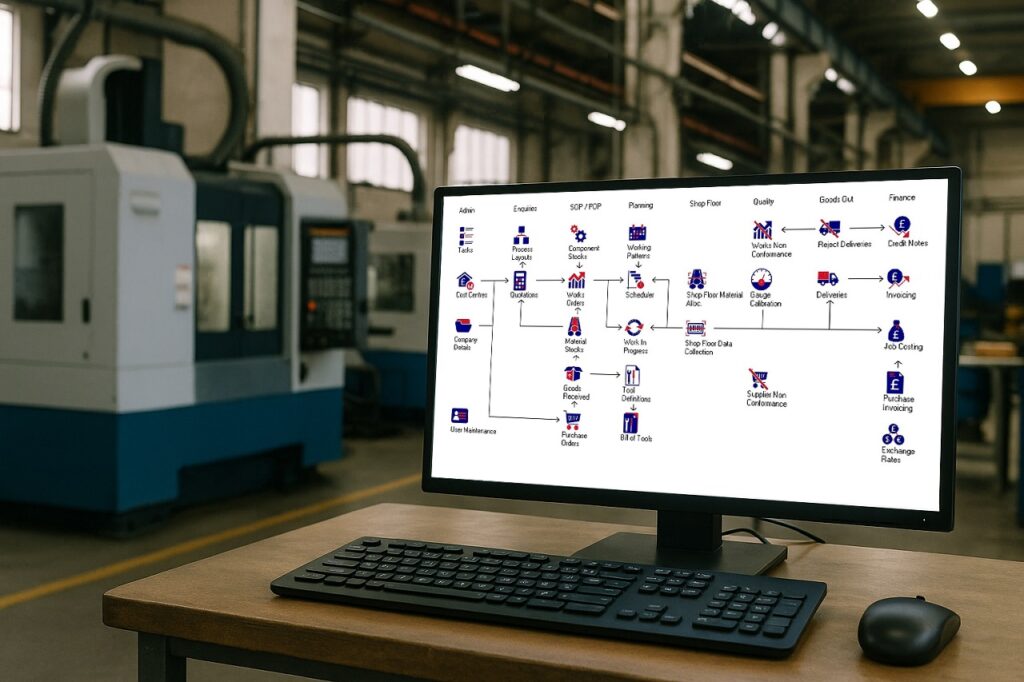

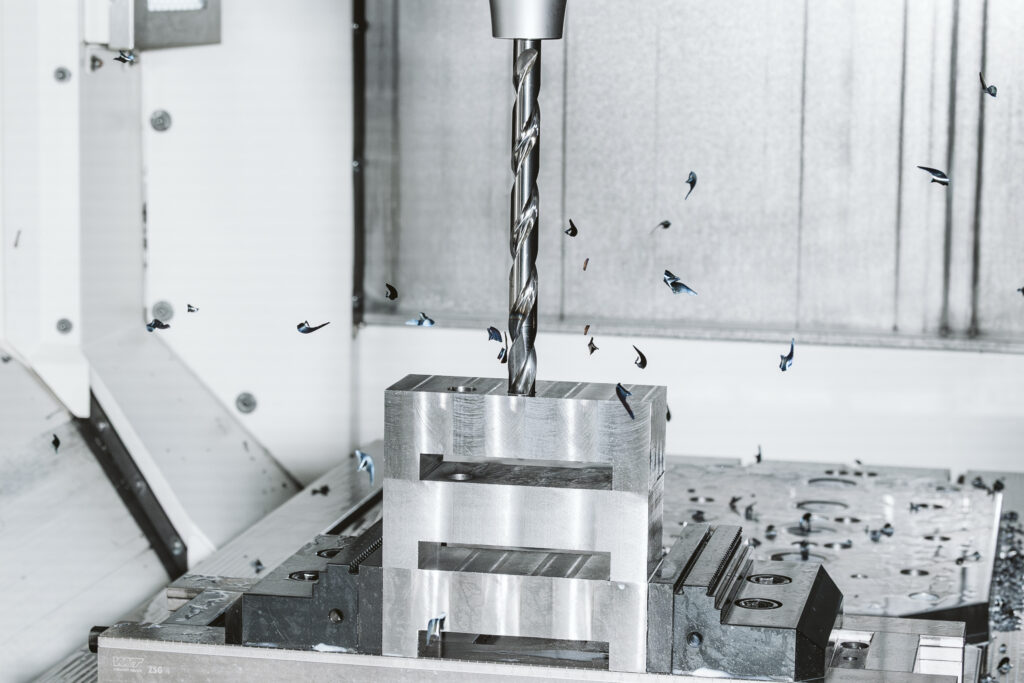

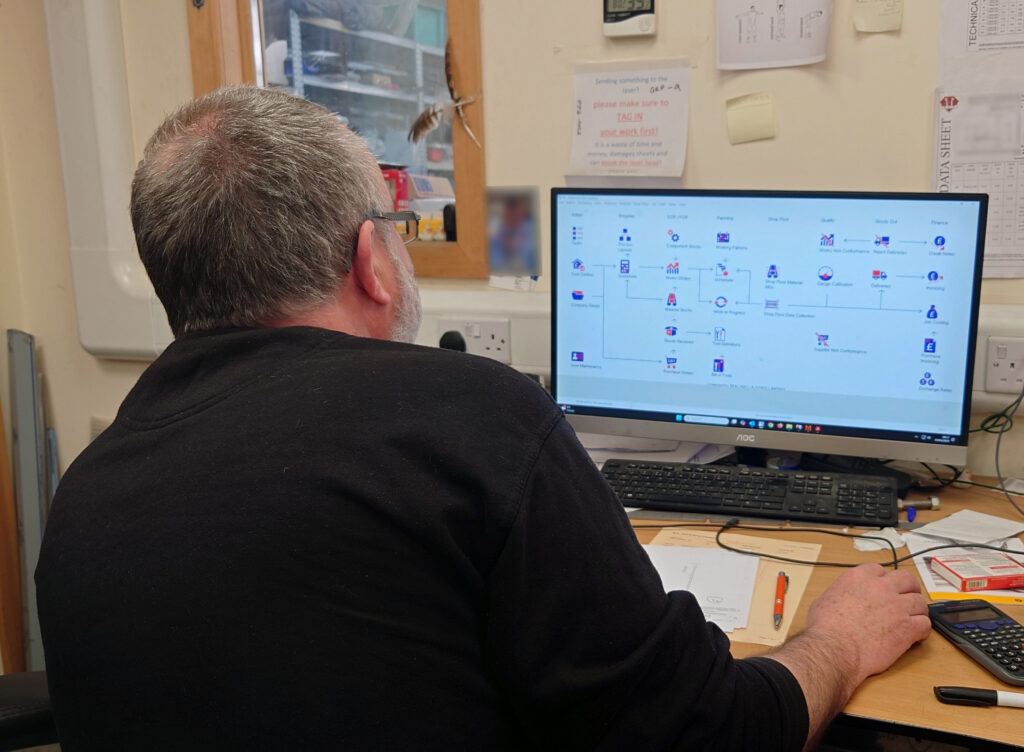

Precision engineering firm invests £250,000 to Enhance quality control

17th June, 2025